Ad blocker usage has doubled worldwide in the past year, but U.S. brands have yet to feel the full impact. Is there still time to save their hides?

Ad blocker usage has doubled worldwide in the past year, but U.S. brands have yet to feel the full impact. Is there still time to save their hides?

It’s a dangerous time to be a media brand, according to Matthew Ingram in Fortune, citing a PageFair report on ad blocking usage around the world.

“The media industry is struggling to deal with a host of challenges, including a loss of power to distribution platforms like Facebook and the shift to mobile consumption. But one of the most life-threatening problems is the ongoing disruption of the business model that most media companies rely on for survival—namely, advertising,” Ingram notes.

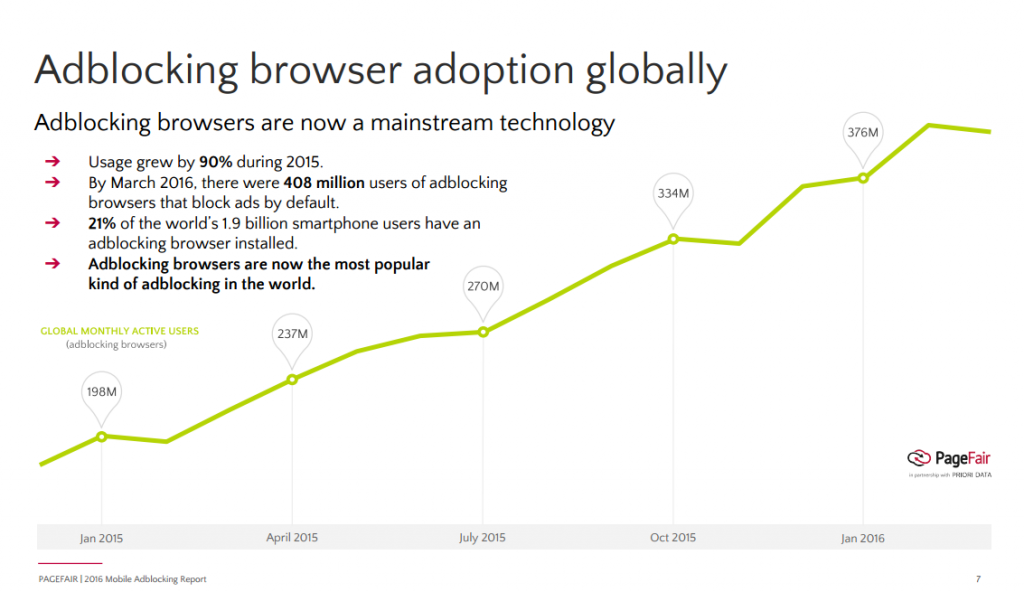

That problem is the prolific rise in ad blocking software and ad-free browsers, which the PageFair report shows has risen by 90% worldwide in the past year.

It’s no secret why: Consumers have had it with mobile bloat and intrusive data mining, and the technology to fight it is easy and widely available, from developers who are quick to say “don’t blame us for this mess.”

Escalating the urgency, Norwegian-based browser developer Opera recently released an upgrade that has ad blocking – including native advertising barriers – baked right in.

“The company claims that by integrating the ad blocker technology directly into the browser code, it is as much as 89 percent faster compared to browsing without ad blocking. It is also apparently 45 percent faster compared to Google Chrome with third-party ad-blocking extensions installed,” writes Ashley Norris in FIPP.

“It will essentially strip out ads created by content recommendation engines like Outbrain and Taboola,” Norris explains. “Native advertising that is hard wired into the editorial pages of the web page will of course still be seen,”

The company, Norris continues, feels it is helping web users take a stand against low-quality advertising.

What’s interesting about the data from PageFair is that U.S. and Europe consumers have been behind the curve in ad blocking adoption.

“At the moment, ad blocking appears to be significantly more popular in countries outside of North America and Europe, according to the report,” Ingram notes. “About 36% of users in Asia block mobile advertising, including 159 million people in China, and more than 120 million do so in India. In Europe and North America, however, only 14 million people use ad-blocking software—and only about 2.3 million of those are in the United States.”

“The PageFair report suggests it’s partly because users in Asia pay more for their data and are trying to reduce consumption by any means necessary. Or it could be that North America and Europe are just behind the curve,” Ingram writes.

What this means for U.S. and European-based media brands is that they’ve only seen the first waves of the coming ad blocking tsunami. The financial implications are staggering.

While some brands beg or threaten users to allow ads, others look to sue ad blocking companies or ask the FTC for help. Many are turning to third-party distribution platforms like Facebook Instant Articles to monetize their content. And a few are working on their own strategies and developing industry standards so ads are welcomed by, rather than repulsive too, readers. But it may be a case of far too little, too late. Surf’s up.

June 22, 2016, 2:53 pm

August 17, 2016, 12:07 pm

PageFair numbers are not even close to being accurate. chrome, opera, and firefox have over 700 million downloads combined add mobile users and o 1 billion internet users block ads and that number grows by 100, 000 plus each day.. so much plagiarism and garbage coming from publishers and bloggers thesedays its unbelievable. No one uses adobe flash and very few still see ads. internet users dont want to see ads dont care id advertisers and publishers go broke and dont care how they feel about it. advertising is finished and thats just the way it is. blocking ad blockers does not work because there are other ad ons that also block content and remove content and scripts “Yet another remove it permanently” aks YARIP, for 1. there are endless ways to remove ads and content from webpages, facebook and the liokes without using just an as blocker, so these attempts by advertisers are a waste of time. good riddance to advertising, the internet will be just fine and thrive without it.

September 21, 2016, 8:05 am

September 30, 2016, 7:51 am

November 3, 2016, 10:56 am

December 8, 2016, 9:43 am

December 28, 2016, 8:13 am

February 6, 2017, 1:13 pm

February 15, 2017, 7:56 am

February 15, 2017, 7:57 am