The number is staggering – in just three months earlier this year, Facebook took down 2.2 billion fake accounts.

The number is staggering – in just three months earlier this year, Facebook took down 2.2 billion fake accounts.

“That number is only slightly less than the 2.38 billion monthly active users Facebook has around the world,” writes Kaya Yurieff in CNN Business. “For comparison, Facebook (FB) disabled 1.2 billion fake accounts in the previous quarter and 694 million between October and December 2017.”

During that same time, the social platform “took action” on close to 20 million pieces of content for violating its terms of service. Hate speech, firearms sales, drug deals and other illegal activities are just some of the content challenges being flagged and removed.

“Hate speech has been particularly challenging for Facebook,” Yurieff writes. “The company’s automated systems have a hard time identifying and removing hate speech, but that the technology is improving. The percentage of hate speech Facebook said it found proactively — meaning before users reported it — rose to 65.4% in the first quarter, up from 51.5% in the third quarter of 2018.”

Between fake users, despicable content and the massive data privacy violations, it’s no wonder that engagement on Facebook is dropping in the U.S. Spending time on Facebook has changed since the good old days, and more people are realizing they just don’t want to be there anymore.

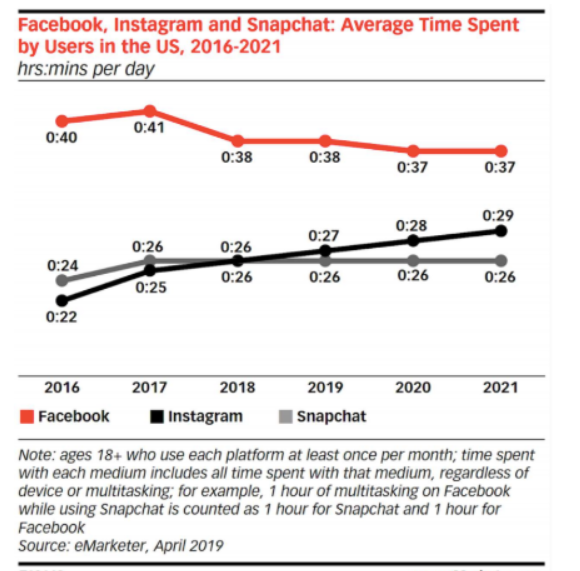

“Daily time spent on Facebook declined by 3 minutes among U.S. users in 2018, according to [eMarketer],” writes Karissa Bell in Mashable. “Users spent an average of 38 minutes per day on the platform in 2018, the report says, down from 41 minutes a day in 2017. eMarketer expects usage to further decline to 37 minutes a day by 2020 and remain flat in 2021.”

“While a few minutes may not seem like that big of a deal, it’s a worrying trend for Facebook, which still depends on its main app for a sizable chunk of its ad revenue,” Bell writes. “And the U.S. has long been one of its most lucrative markets. If the platform can no longer hold users’ attention in the same way, it could take a hit with advertisers.”

With Facebook ready to roll their “clear data history” feature, advertisers will have one more massive challenge to deal with. That announcement came as Facebook faces a potential multi-billion dollar fine from the Federal Trade Commission for the company’s previous privacy practices. As the company pivots to its so-called “privacy-first” mindset, tools like “clear history” will be one important way for users to regain control of their personal data.

Facebook, for its part, is going to phase out their reporting on user growth, Bell notes in a separate article. Instead, they’ll report on the larger “family” of apps that include Facebook, Instagram, Messenger and WhatsApp.

“Instagram remains a bright spot for the company, with usage set to rise through 2021, according to the firm,” Bell writes. “But even with that growth, it will likely be some time before Instagram engagement reaches Facebook’s level. Time spent on Instagram is expected to reach 27 minutes per day in 2018, eMarketer says.”

Clearly the company relies on a massive user base to support their revenue model; moving to “family metrics” means more dodgy user metrics to justify ad rates, in my opinion. It’s entirely possible that Facebook is at the tipping point where they’ve alienated enough users to break their strangle hold on the ad industry.