There’s a glitch in the matrix, folks.

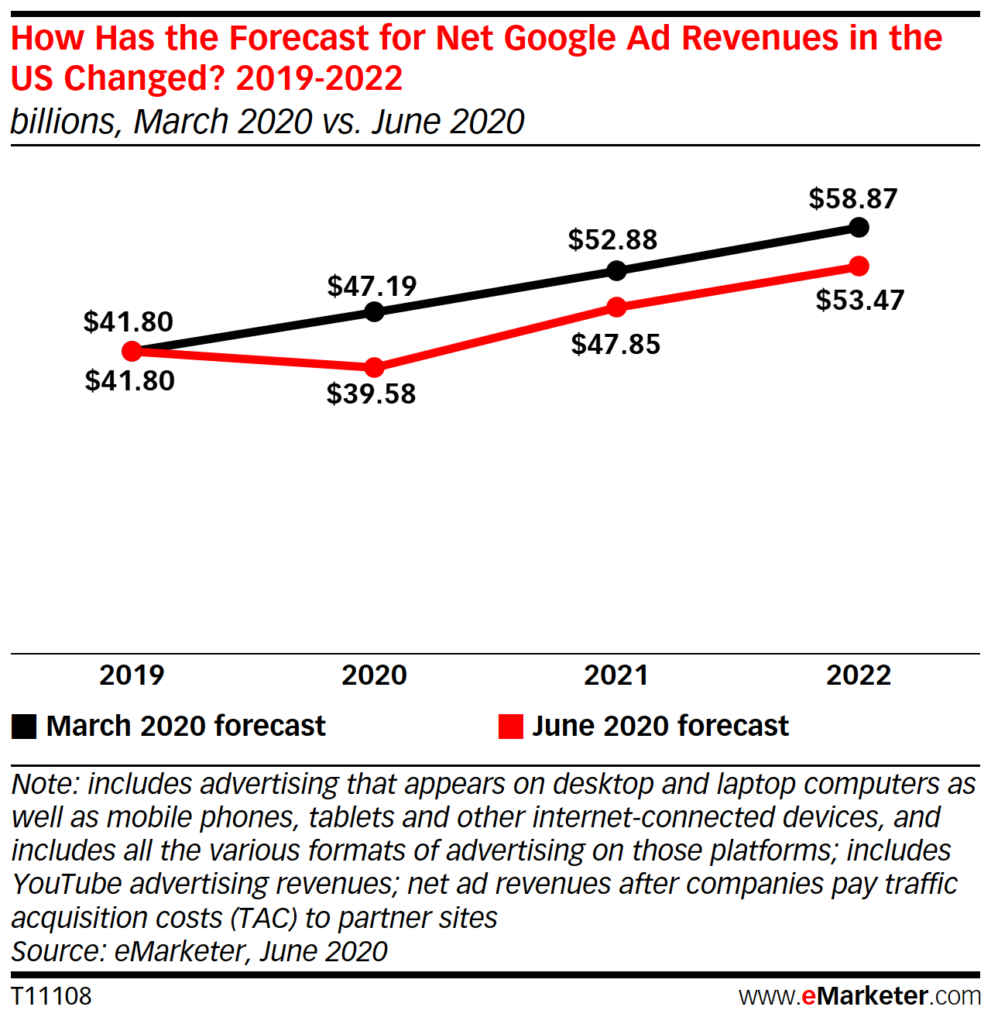

Google, that behemoth of ad revenues, forecast a fairly steep drop in projected revenues from their March 2020 predictions.

Principal analyst Nicole Perrin of eMarketer and Insider Intelligence’s Eric Haggstrom were recently interviewed for an eMarketer podcast to break down what’s happening… and what we can expect.

First, they put this news into perspective: Google processes 6 billion search results a day; Gmail handles 100 billion mail messages every 24 hours; and YouTube (owned by Google) uploads 49 years’ worth of video every day. All of that equated to $34B in profit for parent company Alphabet in 2019.

These new revenue forecasts are Google’s first decline… ever. Search ad revenues for Q1 was up 13% this year, while Q2 was down 2%.

“You can’t ignore the fact that this was their first decline ever,” Atkins said, “but you also can’t ignore that not only did they beat Wall Street expectations, they beat [eMarketer internal modeling] expectations as well.”

Haggstrom also believes the drop, while certainly newsworthy, isn’t unexpected.

“Travel advertising accounts for about 10 to 15% of their total search ad revenue,” Haggstrom said. That means that “everything else had to be pretty well, or considerably well since travel advertising dropped probably about 90%.”

“It’s a really great result for them all things considered,” Haggstrom continues, nothing that ad spending from e-commerce and gaming sites was huge as people hunkered down at home.

One big surprise for the company was the growth of subscriptions for YouTube TV, a product that had been struggling with their paid TV model. With 20 million new subscriptions, the TV service seems to be getting a foothold. Yet their heavy emphasis on sports programming may be a detriment the longer professional sports are sidelined.

As Atkins notes, the interesting thing has been how uniform the drops and subsequent rebounds have been across Google and other ad sellers, both large and small, in the online ad industry.

“We’re just hearing such uniform responses about the bottom of the market having been in late March and April, and slowly climbing out of that again,” Atkins said.

It’s important to understand that prices also dropped when demand dropped, opening the door to brands that may have been priced out of the market initially. The big question remains — will these brands continue to advertise as ad prices climb back up… which they invariably will… especially when government stimulus for business goes away or declines.

Is this a disaster for Google? No, clearly not. But it does prove they are not immune from market forces that drive the rest of us. The coming months will be interesting to watch.