When the Reuters Institute set out to uncover the key issues facing the news industry, they surveyed 233 senior media executives around the world to identify the most important current trends. Their findings are summarized in the Journalism, Media and Technology Trends and Predictions 2020 report, available as a free download.

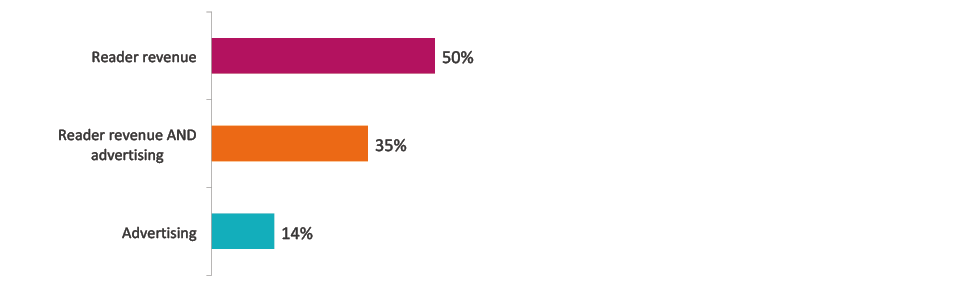

While the report is free, the findings show that the majority of publishers are relying on reader revenue as their main income stream heading into this new decade.

“Publishers continue to bet strongly on reader revenue, with half (50%) saying this will be their main income stream going forward,” writes Nic Newman, Senior Research Associate for Reuters. “Around a third (35%) think that advertising and reader revenue will be equally important, with just one in seven (14%) pinning their hopes on advertising alone.”

The report also points out some telling trends about digital platforms.

“Globally, the report found that the power of digital platforms such as Google and Facebook remains a concern for most publishers, but there are mixed views on regulation,” writes Lyndsie Clark on Niche Publishing Network. “The report found that, overall, publishers don’t want hand-outs from these platforms but would prefer a ‘level playing field’ where they can compete fairly and receive appropriate compensation for the value of their content.”

That hasn’t been happening for most publishers, evidenced by their rather dim views of Apple News+ and FB’s Instant Articles, so publishers are returning to what they know – building a relationship with their readers to generate revenue.

Yet as they turn back to a paid content model, and realize journalism will survive without digital ad revenue, the climate of the industry is of course on their minds.

“Almost three-quarters of our respondents (73%) say they feel confident or very confident about their company’s prospects in 2020,” the report continues. “It’s a surprisingly upbeat assessment given continuing editorial and commercial uncertainty but reflects optimism amongst many publishers that reader revenue and diversification strategies are starting to pay off. These same media executives, however, are less confident about journalism in general (46%) and public-interest journalism in particular. There is widespread disquiet about the decline of local news and the economic and political pressure on journalists trying to hold the rich and powerful to account.”

Beyond the bottom line, news execs are also concerned about the growing challenge of journalistic response to political storytelling.

“In our survey, 85% agreed with the proposition that the media should do more to call out lies and half-truths, but it is not clear that this approach cuts through with audiences, and it may even be hardening criticism of the media from both left and right,” the report continues.

There remains skepticism that policymakers will help journalism this year, and in fact one in four respondents feel they could do more harm than good. Overall, however, they remain confident that they can attract and retain good talent, especially in editorial positions.

While we celebrate this return to a focus on paid content, there is a dark side effect to consider.

“With more high-quality journalism disappearing behind registration barriers and paywalls, the democratic dangers may also become more apparent in the year ahead,” the report continues. “The fear is that serious news consumption will be largely confined to elites who can afford to pay, while the bulk of the population pick up headlines and memes from social media or avoid the news altogether.”

Yet all is not despair; the mood overall was one of “quiet determination” and a focus on delivering long-term value for the audience.

“There is no one path to success – and there will be many publishers that do not make it – but there is greater confidence now that good journalism can continue to flourish in a digital age,” the report concludes.

May 11, 2020, 12:41 pm